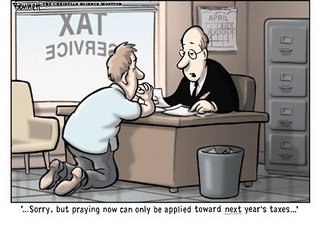

"There is nothing sinister in so arranging one's affairs as to keep taxes as low as possible. Everybody does so, rich or poor; all do right. Nobody owes any public duty to pay more than the law demands; taxes are enforced extractions, not voluntary contributions!” - US Judge Learned Hand

The average UK citizen works from New Year's Day to May 24th solely to pay their taxes. Effectively, for a third of a year everyone in the UK is a civil servant. Income tax, national insurance, VAT, corporation tax, capital gains tax ... tax, tax, tax, the list is endless.

And that's not just in one year, that's every year. This happens all the way through your life. And after tax has been deducted, the little that remains is taxed again! If you spend it you're taxed. If you save it you're taxed.

How Little Of £100 You Get To Keep ...

Of £100 earned, 10% is paid in National Insurance contributions (nothing but a euphemism for an additional tax on income) and 22% is paid in Income Tax (40% for higher rate taxpayers). Of the remaining £68 of take-home pay let's say that over a week you spend it thus:

* £15 for a meal out

* £8 on cinema tickets

* £16 in petrol

* £3 put by for electricity

* £7 on some cigarettes

* £9 on a few drinks down the pub

* £4 paid out in insurance premiums

* £3 put aside for Council Tax

* £2 put by for Road Tax

Sound reasonable? Obviously 100% of the last two items are wholly tax. Five per cent of your electric bill goes to the taxman and 4% of any money you pay to protect yourself with insurance. Of the £23 you spend at the flicks and eating out, 17.5% goes to the government in VAT. While you're enjoying yourself, so is the Treasury; they take £4.03 from you for the evening.

35% of a well-deserved drink goes direct to our masters, and a recent AA campaign followed by the picketing of oil refineries serves to remind us that a staggering 85% of the money spent on petrol is snatched by the taxman. Eighty five per cent! But even that is not the worst. The state loves a smoker, of course, and from the money spent on cigarettes an astonishing 88.9% enters its coffers.

It brings tears to the eyes. Altogether, a full £32.31 of that week's expenses goes straight to the taxman.

Of the £100 earned, £64.31 will have been paid to the government in tax. At the end of the day, all you will have to show for it is £35.69 in goods and services. A higher-rate taxpayer will retain a miserly £21.69.

Oh, and we haven't even taken into consideration the host of taxes on business, employers national insurance contributions, airport taxes, capital gains tax ... and then there's stamp duty, where you hand over thousands just because you decide to move house! Somebody is taking us for a ride.

Don't think for a moment that European federalisation will stop with the Euro. The Germans are already making ugly noises about harmonising taxes throughout the community. In addition to the £11 a week every man, woman and child in this country contributes to the scandalously-corrupt EU, there'll be no escaping having to cough-up even more in tax – higher income taxes and higher purchase tax. When VAT rates are inevitably 'harmonised', books, newspapers, children's clothes and even our already over-priced food, presently with no VAT added, will increase by 20%... overnight! Does that thought sit comfortably with you?

No wonder the ex-Paymaster General, Geoffrey Robinson, secretes his considerable fortune offshore, tied up in unravelable trusts. A politician who knows how to make money knows how to keep it! Especially when he's privy to what's over the horizon. If tax avoidance is good enough for a Paymaster General, then I'm pretty sure it's good enough for the rest of us.

And look even further into the future. Whatever may be left at the end of your life doesn't escape the taxman either; a significant proportion of your estate... what you've managed to build up over the years will be taken in inheritance tax.

Marvellous, isn't it? You spend all your life trying to protect your family and build something for their future, and the government steps in and grabs a large chunk of it when you're dead and buried and hardly in a position to complain – just when the family you've left behind is at its most vulnerable. Civilised, aren't we?

The government trys to put a spin on those avoiding tax as, somehow, not good citizens, or they try to make it sound sinister and morally currupt. The simple fact is that it is your right to organise you tax affairs in the most efficient way possible. I started with a quiote from a US judge and I will end with a quote from a UK Law Lord, Lord Clyde.

"No man in the country is under the smallest obligation, moral or other, so to arrange his legal relations to his business or property as to enable the Inland Revenue to put the largest possible shovel in his stores. The Inland Revenue is not slow – and quite rightly – to take every advantage which is open to it under the Taxing Statutes for the purpose of depleting the taxpayer's pocket. And the taxpayer is in like manner entitled to be astute to prevent, so far as he honestly can, the depletion of his means by the Inland Revenue.”

Ex Dividend Stocks for April 2022

3 years ago

No comments:

Post a Comment