Small Company Investment - Penny Shares

Small Company Investment - Penny SharesWhen I was a child we were fortunate enough to live near acres and acres of countryside which presented a small boy and his friends endless possibilities for adventure and mischief. My particular set of friends were always building dens, one particular den took us months to carve out of mud under a huge mass of bushes and trees, but the finished job looked like a home fit for a Hobbit. It also happened to be not to far from a small orchard, the owners of which also grew vegetables in their gardens.

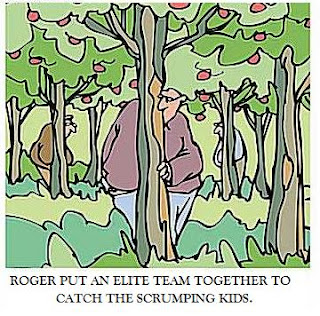

Our favourite pastime was scrumping apples and potatoes and taking them back to the den where the apples would be the entre and the potatoes wrapped in foil and thrown on a fire were the most amazing main course.... for a 10 year old adventurer. Of course sometimes we would get caught, sometimes the potatoes were rotten and sometimes we went hungry, at least until tea time. Of course Karma comes to visit eventually, we have an apple tree in our garden and neighbors with children. Our crop is not what it should be..

The reason I romance about about this is that in the investment marketplace there is excitement, of course there is, but rarely do we experience the absolute thrills that we did as kids. The nearest we get is making a huge profit on an investment, a risk we took that turned out right. The financial equivalent of scrumping and no place is better to do this than the small cap market.

Yes, there are a lot of rotten apples out there, but when you manage to find a good one that returns huge money, there is, in my opinion, nothing like it. Image you had invested $10,000 in Wal-Mart in its IPO in 1970, you would have $130,000,000 now. Southwest Airlines would have returned (at its high) $2.7mn on the same investment. $10,000 in Dell Computers as late as 1990 would be worth $6mn and I do not even want to do the numbers on Buffets money machine, Berkshire Hathaway.

In the UK in recent years Asia Energy would have been a '10 bagger' in less than three months and there are many, many other companies that would have returned this and more. The incentive to invest is there, that is for sure, but it is a market place that inspires risk takers and also instills fear into investors. The only thing to fear, however, is not "fear itself' as FDR said but yourself. That's right, in this market place you need to fear yourself. The propensity to believe every rumour, watch and believe every bulletin board post and trade accordingly will almost always lose you your small cap investment stake and that would be a shame because it can be very rewarding. You need to approach the market place with discipline and with a strategy.

So how does one trade penny stocks? Are there any techniques that work best? Technical analysis that uses indicators and statistics to forecast price movements is one possible approach. However, trading small stocks has, for the most part, been shunned by the technical analysis community. Volumes of less than 400,000 to 500,000 shares a day make analysis unreliable and liquidity a challenge for trading any size. So what do you rely on?

Traditional research is always the best start if you are looking to be a long term player in the field and these days, with the advent of the Internet, there are many helpful sites that aid you in this task. But, by the nature of the reporting rules, you will be behind the curve on historical numbers, with a Blue Chip this is not really problem (unless it is an Enron situation) because if a company made €50mn last year you can be pretty sure that they are not going to go bust by looking at the accounts (assuming they are true, of course). But with a small cap who may have had €1mn in cash in last years accounts and earnings of €5mn, there are various factors that could have wiped the cash out and killed the earnings. There is also a chance that their earnings have gone to €20mn....

So looking at the company accounts is a first, but with small cap shares there is more work needed to be done on the sector. Do they have a good product? Is it reviewed by anyone, anywhere. Could you speak with a client of the company and ask their thoughts on the target company's product. For me, one of the biggest things to look at is management. Many a smaller company with a fabulous product, a growing client base and a good position in the market place has gone bust because the management were outgrown by the success of the business, and they screwed it up.

At the height of the Internet Bubble (Version 1.0) I was at a meeting called 'First Tuesday", you may have heard of it. It was, basically, a get together of investors and Internet entrepreneurs with the concept of putting money and ideas together. At this meeting was a presentation by Boo.com who were discussing their version of world domination and how they were spending the millions they had just raised.

When one of the management team had finished speaking he introduced a lady who was part of the team and part of that introduction was "she is so good we fly her into the UK from LA every week". I turned to my business partner and said "Lets go". My premise being that nobody in the world is good enough for a start up company to pay for, conservatively, $20,000 per month of flights to come to work. If she is that good they should have made her come to London to live and if she was that dedicated to making the business a success she would have made that commitment.

True enough Boo.com disappeared shortly afterwards after having spent £80mn of venture capital and also leaving £12mn in debt. Management and their commitment are a critical part of investing in a small cap. This doesn't mean that they have to be industry gurus and well known names, in fact sometimes this makes me suspicious. I look up how many directorships they have, if they have 20 or 30, what do they care if the one you are about to invest in goes wrong?

My favourite type of manager is one that works in the company 24/7, who has a big enough financial commitment to make it hurt if it goes wrong and make a difference to his life if it goes right. One who knows the sector he is in, inside out, and who has the forethought to have taken on others in his management team that have the same commitment. In the necessary due diligence meetings when hard questions have to be asked, I love it when a CEO gets annoyed with me criticising his business model. I have had CEO's visibly shaking with rage because I questioned their plan in some shape or another. Those guys are the ones we back.

Also a CEO needs to keep his investors up to date through regular press releases or RNS announcement. I absolutely abhor management who do not keep communication up with their shareholders, good or bad, it is arrogance and insulting and a guaranteed path to failure. I spoke with a CEO years ago on the subject and gave him my speech over dinner about how this element of running a listed company is critical, his response? "I will look after the business, the share price will look after itself". He is no longer CEO of that company, or any other.

Another element of making good money in this space is by watching the rumour mill. This is extremely risky but can pay off huge dividends. These days there are a lot of people who use bulletin boards such as ADVFN and Moneyam. Yes, there is an abundance of 'rampers' who post all sorts of drivel about how this company will be 500% by this time tomorrow and those who say the company is going bust (hoping to gain from shorts) so you have to be careful. But they are worth looking at because some posters give an excellent insight into companies. If you are looking for a site to use I would recommend Motley Fool, the community is very good and the administrators of the site try to cut out most of the rubbish.

You can be sure we are lurking on the same bulletin boards you are... scrumping, just like the old days, except this time it is for profits, not potatoes.

No comments:

Post a Comment